Cybersecurity in Finance - Risks and Security Plan for 2025

With every year, the global business landscape is faced with the ever-nuanced cybersecurity threats that render the entire landscape vulnerable; at the mercy of the malicious threat actors. The global economy entered 2024 with momentum amid easing supply chain pressures, moderating inflation, and increased regulatory scrutiny. These factors are testing the resilience of financial industry business models and pushing financial industry professionals to explore innovative avenues for value creation while managing emerging cybersecurity risks and privacy concerns.

Is Cybersecurity in Finance a thing?

Cybersecurity in the financial industry involves stringent measures that could be aimed at digital asset protection, customer information, and business operations from cyberattacks. As the financial industry professionals handle sensitive data and monetary transactions; it has become the top target for many malicious threat actors to deploy threat activities for mean gains.

Digital proliferation is blurring global borders, making it daunting to harmonize growth initiatives with shifting regulatory essentials. As the demand for seamless and personalized experiences grows, so do the challenges of providing comprehensive security and data privacy, making digital identity management more complex than ever. Quality Cybersecurity education is of utmost importance in the years to follow and safeguard against malicious cyberattacks.

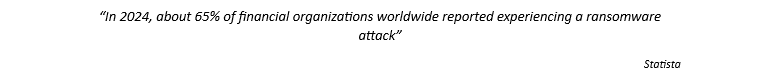

With this, it also reflects deeply upon the core aspect of artificial intelligence’s role in strengthening financial cybersecurity. Let us understand.

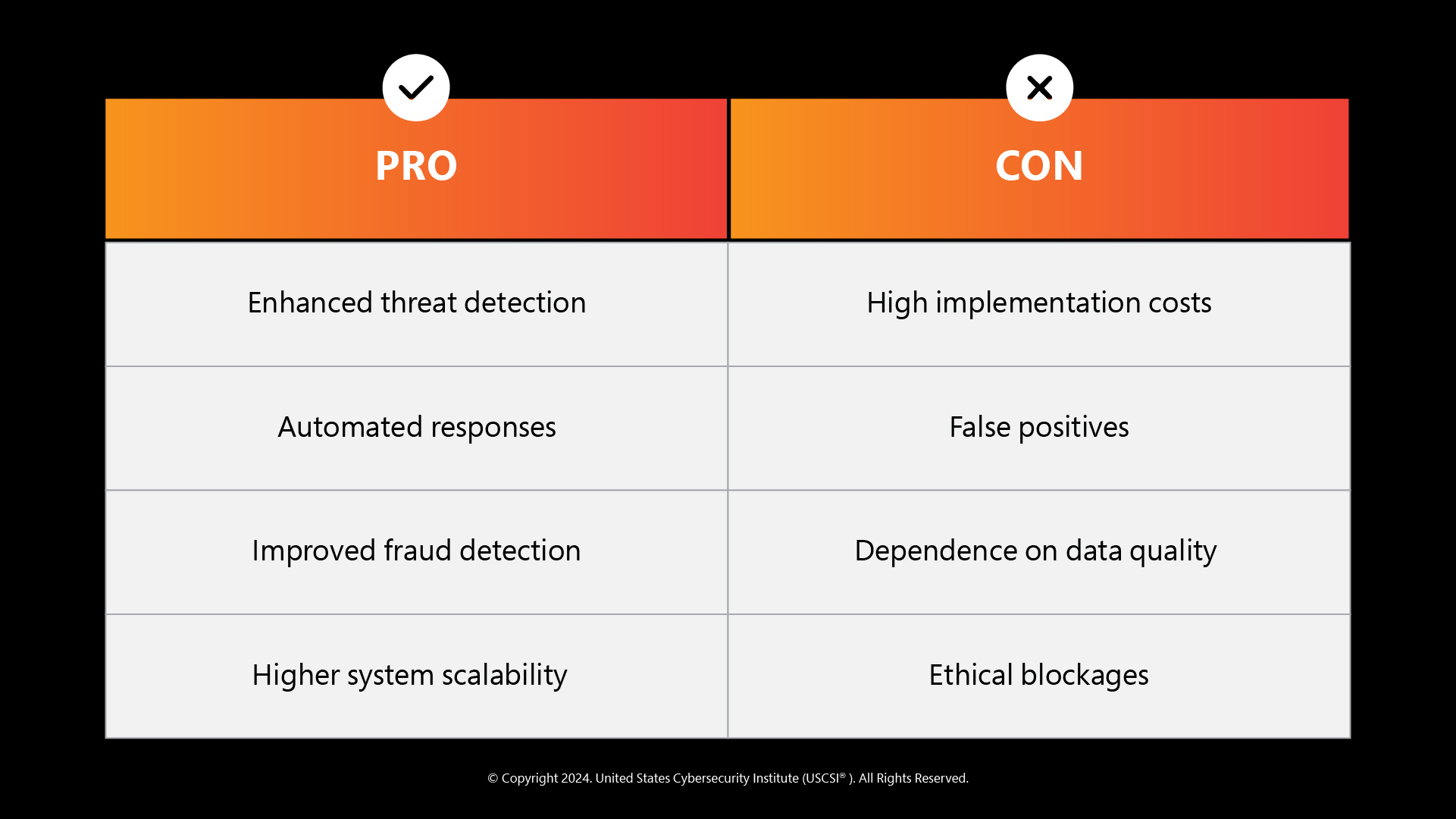

Here are the top 10 countries and global regions that have showcased the highest cost of data breach over the years, landing in 2024 (in USD million); with the USA topping the list:

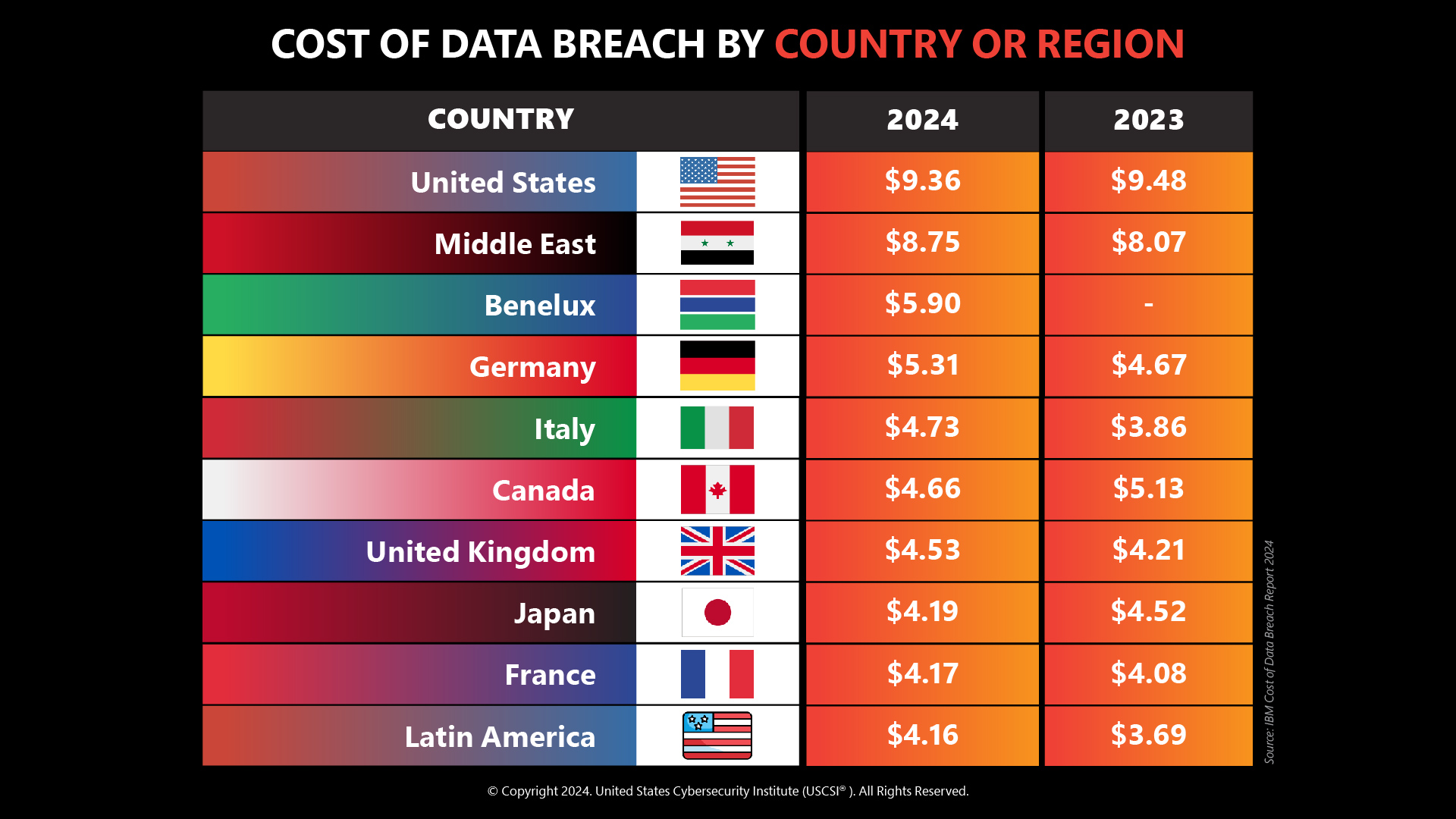

Let us proceed to understand what must be considered for cybersecurity in the finance sector and navigate the challenges successfully (as highlighted by KPMG).

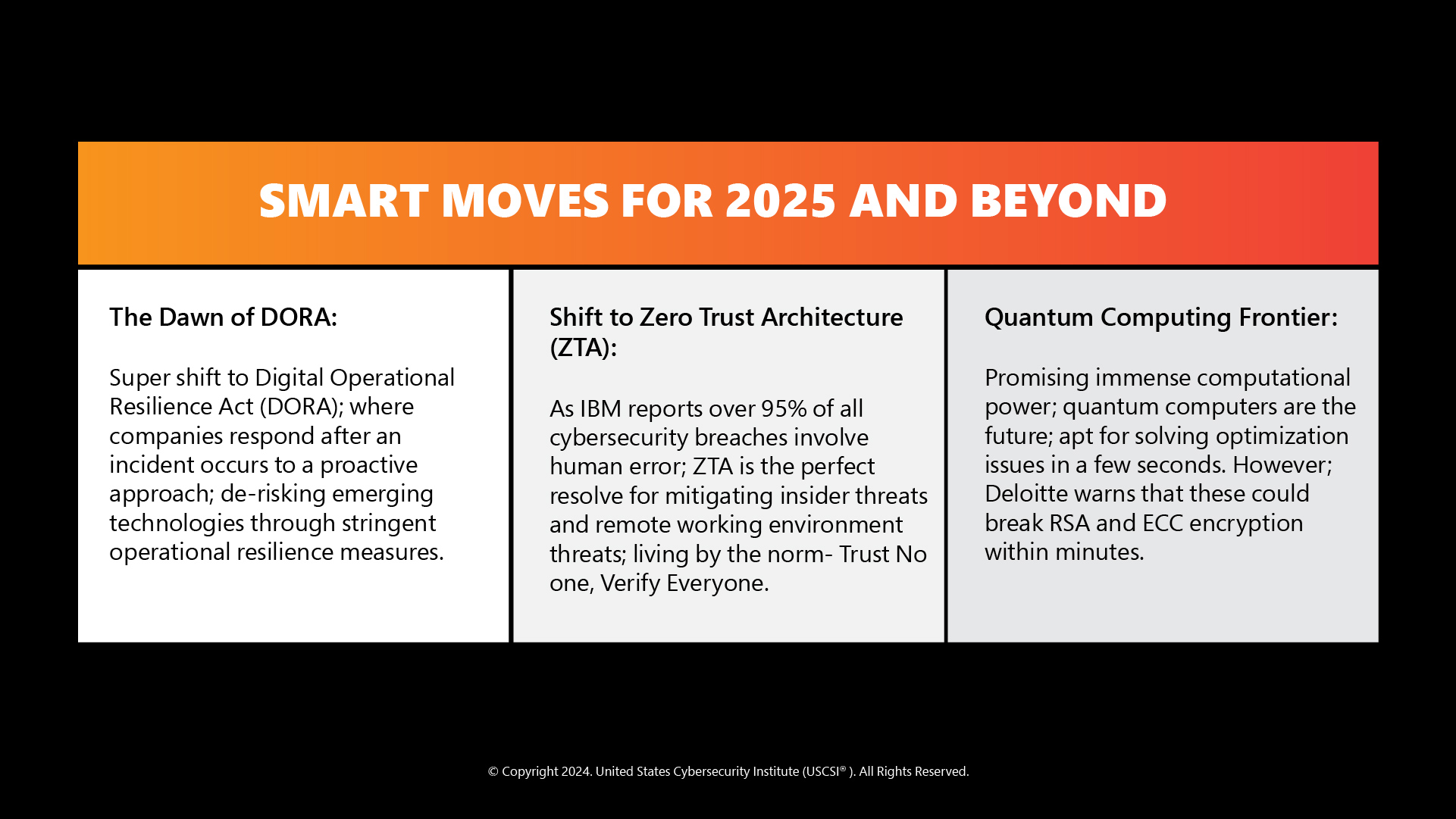

However, taking necessary action beforehand is a great idea. Let us understand what should be the top priorities for cybersecurity experts in the finance sector to strengthen the cybersecurity environment. Furthermore, added to the above; other cybersecurity solutions for financial services can come in handy during testing times.

- Developing and implementing a sophisticated framework for regulatory compliance that can adapt to different, constantly evolving laws across jurisdictions.

- Aligning investments with local infrastructure and cloud technologies that meet data sovereignty requirements.

- Establishing rigorous vetting and monitoring processes for supply chain security.

- Leveraging innovative technologies like AI and blockchain to automate tedious compliance tasks.

- Implementing automation for effective vulnerability management and proactive incident response.

- Strengthening CIAM and cybersecurity strategies elevates security and customer experience.

- Incorporating identity analytics for advanced fraud detection and prevention.

- Advocating for standardized authentication practices across the industry.

There is no denying the fact that cybersecurity has been ignored in a majority percentage of the financial sector enterprises as well. This is the time to invest in the right guys to guard your systems and financial online data and sensitive information. Hiring the right people with the best cybersecurity training is the way ahead. The financial sector has always been on the radar of malicious threat actors from the beginning. Cybersecurity must become a priority for the financial industry in the wake of the following cybersecurity threats evolving over the years.

Evolving Cybersecurity Threats:

- Social Engineering- Convincingly impersonate a co-worker; gaining the victim’s trust to request private company data or fund transfer

- AI-enabled Phishing- Allows scammers to create believable text matching any region’s tone, expressions, or idioms

- Advanced Persistent Threats (APTs)- Sophisticated attacks to infiltrate an organization’s IT network or system to steal data or monitor online movement

- Ransomware- Asks for huge ransom to unlock their systems when attacked by malware

- DDoS Attacks- Disrupts operations and propagate specific agendas via powerful botnets and hackers

- Supply Chain Attacks- A breach in the vast network of third-party services; that requires stringent vendor management and security practices

- Insider Threats- Operated through weak links in the disgruntled employees of an institution

- Cybersecurity Knowledge Gap- Talent and awareness gap among employees cost heavily due to lack of motivation and lag behavior

If you are in finance or plan to build a career as a cybersecurity specialist for the financial sector; this could be your beginning with the right cybersecurity certification program to ramp up your skills and threat management capabilities. Investigate and begin strong!