The Indispensable Role of Cybersecurity in the Finance Sector

The root cause of all the attacks is financial gains. So, how come cyber attackers leave lucrative financial institutions?

Finance industry is the most preferred target for cyberattacks. Gaining unauthorized access to user accounts, gaining access to sensitive banking information, and access to networks or systems can help cyber criminals cause serious financial damages to account holders and financial institutions.

Banks, traders, insurance services, and all kinds of financial institutions today understand the importance of going online. Online banking and other services offer unmatched customer experience allowing them to manage their accounts, do transactions, and seek support at their fingertips. So, organizations cannot ignore the importance of taking their businesses online. However, they also cannot ignore the importance of ensuring robust cybersecurity measure to keep everything in place and secure all the critical information and infrastructure.

In this article, let us discuss the indispensable role of cybersecurity in the finance sector and the steps cybersecurity professionals must take to ensure the maximum safety of users as well as institutions.

Overview of Cyber Threats in the Financial Sector

Some of the most common forms of cyber-attacks in the financial sector include:

- Phishing – In this, attackers try to trick individuals into revealing their confidential financial information either through fraudulent emails or fake websites

- Malware – In this malicious software is injected into systems to steal data and disrupt operations

- Ransomware – This is a common form of attack where the attacker encrypts the data and demand ransom to unlock it.

- Denial of service (DoS) attacks – This attack refers to overwhelming the target systems and server with unnecessary requests from compromised devices making the service inaccessible to genuine users.

- Data breaches – Unauthorized access to sensitive information can lead to identity theft and financial fraud.

Top Cybersecurity Challenges in Finance

Though there are various kinds of cybersecurity risks to financial institutes, as we mentioned above, the three major cybersecurity challenges cybersecurity specialists often face are:

- Detection and Response (D&R)

One of the biggest cybersecurity challenges is the lack of investment in efficient tools and technologies to identify and respond to threats promptly.

To address this, cybersecurity professionals need to build a robust Security Operations Centre to detect and respond to such threats in real-time.

Technology is changing rapidly, and especially with the advancement in AI, cybercriminals have become highly advanced in their approach. So, organizations need to keep themselves up to date with the latest technological advancements and cybersecurity tools to combat the techniques used by attackers.

- Identity and Access Management

Identity and access management is an important part of cybersecurity in the financial sector. Even though it poses a significant challenge because of its complexity, regulatory compliance, third-party risks, and insider threats, it can be addressed effectively through proper security measures.

Cybersecurity specialists in the financial sector need to implement strong IAM strategies to address the associated challenges. They need to centralize IAM platforms, use strong authentication methods, offer privileged access management, regularly review access, and monitor all their accounts and operations regularly.

- Cloud Security

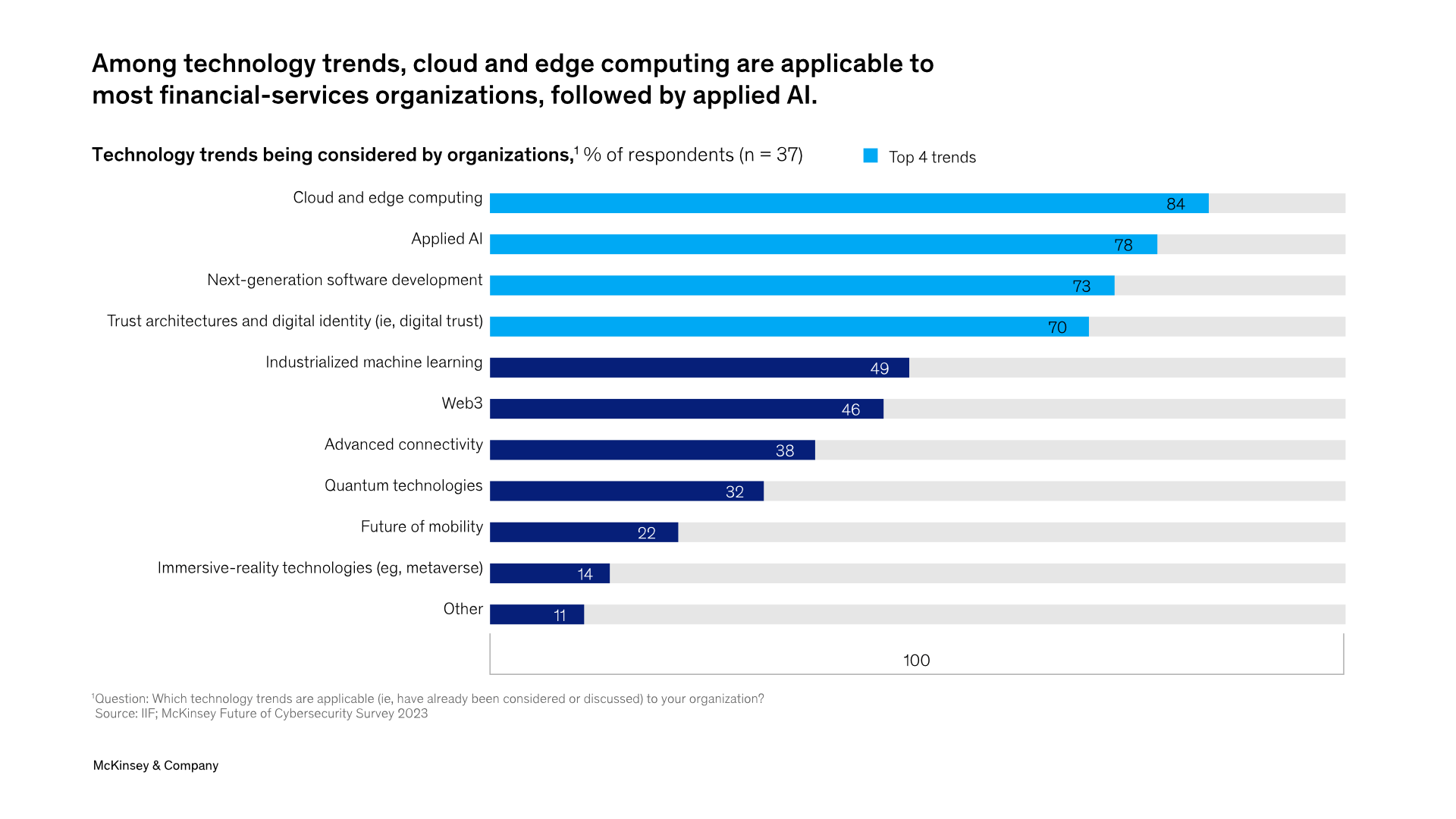

Cloud technology is on the rise. Financial institutions are actively switching to cloud infrastructure as inferred from the following graph.

Also, it is among the fastest emerging technologies in the world because of the scalability and flexibility it offers. However, it also presents huge cybersecurity risks such as data privacy breaches, data exfiltration, supply chain attacks, cloud-native threats, and so on.

Therefore, we can now see a rise in cybersecurity financial sector jobs that can effectively mitigate these cybersecurity risks. Organizations need to adopt robust cloud security strategies, conduct regular risk assessments, encrypt data, implement strong access controls, and use advanced CSPM tools to effectively address these security challenges.

How Incorporating Cybersecurity benefit Financial Institutions in 2025?

Cybersecurity is very important in the finance sector because of the sensitive nature of information handled. Banks, insurance companies, traders, etc., have to deal with huge amounts of personal and financial data and here is why cybersecurity is paramount:

- To protect sensitive and confidential consumer data. Data breach can lead to identity theft and financial frauds. According to IBM Data Breach Report 2024, the average cost of data breach has reached $4.88 million, 10% rise over previous year.

- The global cost of cybercrime is expected to reach $10.5 trillion by 2025, as predicted by Cybersecurity Ventures. Cybersecurity in finance can help to significantly prevent financial losses

- To ensure and maintain customer trust as data breaches can lead to eroding trust and customers switching to competitors

- To ensure compliance with various cybersecurity regulations and standards such as GDPR or CCPA

- Also, cybersecurity in finance sector can help protect critical infrastructure like payment systems and clearing houses over which the financial institutions heavily rely upon.

Career in Cybersecurity in the Finance Sector

Cybersecurity professionals are in huge demand in all industries, and when it comes to the finance sector, here are some popular cybersecurity financial sector jobs you can consider:

- Identity and access management architect

- Cybersecurity incident responder

- Penetration tester

- IT cybersecurity specialist

- Intelligence analyst

The employment opportunities in the cybersecurity domain are exploding and therefore, it is recommended to update yourself with the latest and trending cybersecurity skills, tools, and technologies. Enroll in top cybersecurity certification programs to stay relevant in the market and enhance your credibility and employability.

Conclusion

Cybercriminals do not spare any opportunities to cause harm and steal information or money. And for them, organizations in the financial sector are the most attractive targets. Therefore, financial institutions need to have strong and robust security measures in place, focusing especially on areas like cloud security, identity and access management, and incident detection and response. They may also integrate the latest AI technologies to automate various threat detection and response tasks. These institutions are actively looking to hire the best and most skilled cybersecurity professionals, therefore, earning cybersecurity certifications, gaining the latest in-demand skills, and validating expertise may help tremendously. So, register now.